Money Laundering And Bank Risk Evidence From Us Banks

How banks identify and assess money laundering and terrorist financing MLTF risk in businesses and establish AMLCFT programs etc as a basis for implementation. Such a review is discretionary if a bank is convicted of BSA violations and in practice is not conducted.

Layering Aml Anti Money Laundering

Regulators against banks for money laundering ML in a sample of 960 publicly listed US.

Money laundering and bank risk evidence from us banks. If a bank is convicted of money laundering subject to a required regulatory administrative hearing the bank could lose its charter or federal deposit insurance ie be forced to cease operations. AU - Uymaz Yurtsev. Moreover the impact of ML on bank risk is.

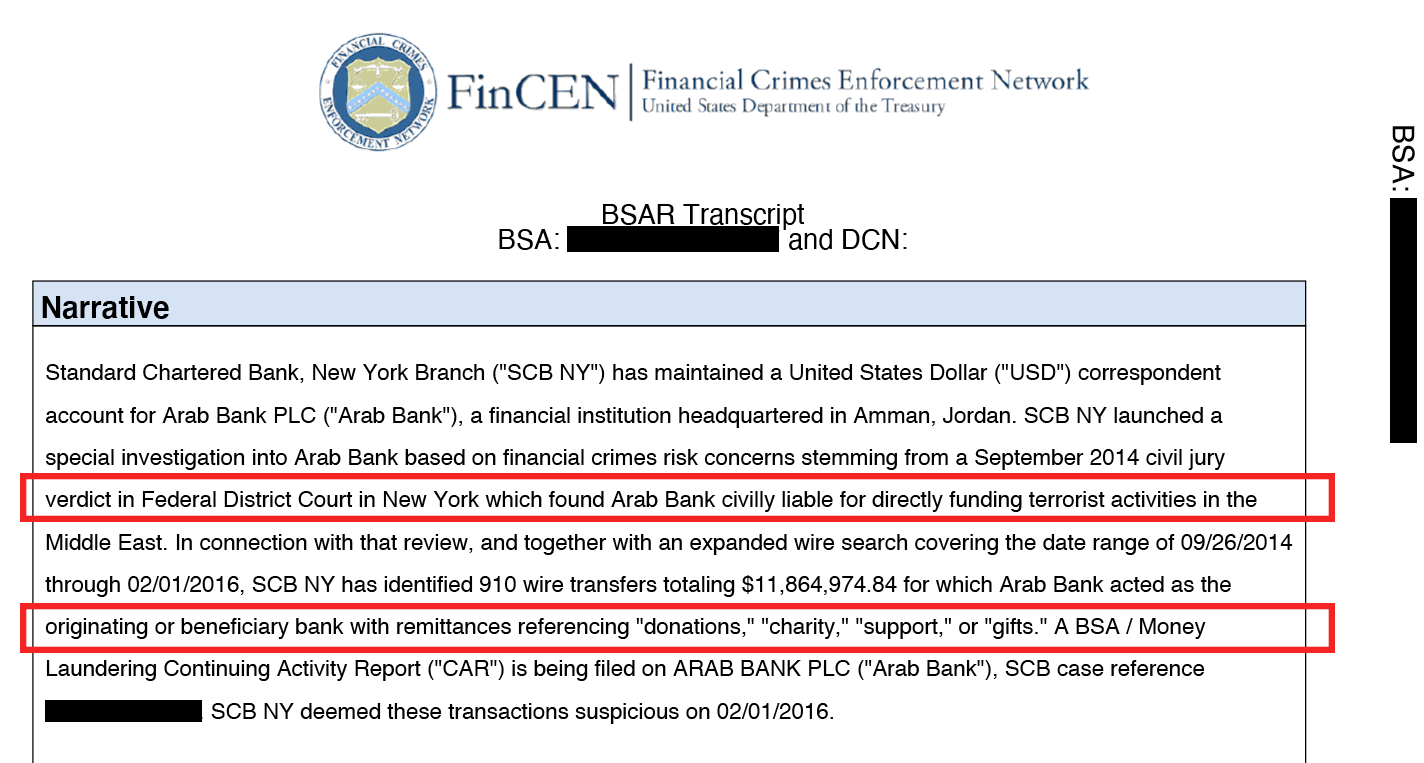

We found little evidence of assessment by internal audit of the money-laundering risk in correspondent banking relationships. N2 - We test for a link between bank risk and enforcements issued by US regulators against banks for money laundering ML in a sample of 960 publicly listed US banks over 2004-2015. Evidence from US banks.

Regulators against banks for money laundering ML in a sample of 960 publicly listed US. Institutional investors search for similar. We find that money laundering increases bank risk according to several measures of risk with the effect on risk only partly mitigated by large and independent executive boards and accentuated by powerful CEOs.

Yener Altunba John Thornton Yurtsev Uymaz. In addition the internal control system should include relevant written policies and procedures for identifying assessing. According to the announced data criminals carry out 97 of money laundering activities through financial institutions.

PDF We test for a link between bank risk and enforcements issued by US. This is unsatisfactory given the high money-laundering risk which is agreed internationally to be inherent in correspondent banking. Moreover the impact of money laundering on bank risk is.

We find that money laundering increases bank risk according to several measures of risk with the effect on risk only partly mitigated by large and independent. Find read and cite all the research you need. MLrelated enforcements are associated with increased bank risk on several measures of risk with the result robust to a variety of estimation methodologies.

Evidence from US banks 1. We test for a link between bank risk and enforcements issued by US regulators against banks for money laundering ML in a sample of 960 publicly listed US banks over 2004-2015. T1 - Money laundering and bank risk.

For this reason banks must identify the risks by fulfilling. Introduction The literature on the determinants of bank risk has largely ignored the impact of engaging in money. Facilitating procurement of demand drafts for the clients from their own bank and other banks against cash Using accounts of other customers to facilitate conversion of black money into white and advising customers in investment plans to escape the purview of income tax With these allegations financial institutions face.

Considering that banks mediate millions of financial transactions during the day banks are at great risk for financial crimes. Criminal organizations try to launder the money to use the crime earnings they get from crimes. We test for a link between bank risk and enforcements issued by US.

Moreover the impact of ML on bank risk is. AU - Altunbas Yener. Banks with powerful CEOs and smaller less independent boards are more likely to take risks and be susceptible to money laundering according to new research led by the University of East Anglia UEA.

Regulators against banks for money laundering ML in a sample of 960. We had no major concerns about banks compliance with the Wire Transfer. MLrelated enforcements are associated with increased bank risk on several measures of risk with the result robust to a variety of estimation methodologies.

We test for a link between money laundering and bank risk in US banks. The study tested for a link between bank risk and enforcements issued by US regulators for money laundering in a sample of 960 publicly listed US banks during the period 2004-2015. Evidence from US banks authorYener Altunba and John Thornton and Yurtsev Uymaz journalInternational Journal of Finance Economics year2020.

Money laundering and bank risk. All banks have Anti-Money Laundering AML systems in place yet global money laundering transactions are still estimated at 2 to 5 per cent of global GDP US800 million and US2 trillion but only 1 per cent are seized by authorities. Evidence from US banks articleAltunba2020MoneyLA titleMoney laundering and bank risk.

Evidence from US banks. We test for a link between bank risk and enforcements issued by US. Organizations failure to manage the risk of money laundering.

Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as the processing of criminal proceeds to disguise their illegal origin in order to legitimize the ill-gotten gains of crime. Financial crime especially money laundering remains a complex issue for financial institutions to tackle. A banks internal control system and its amendment should be approved by the Board of Directors.

3 Money laundering and bank risk. ML-related enforcements are associated with increased bank risk on several measures of risk with the result robust to a variety of estimation methodologies. AU - Thornton John.

Contribution to journal Article. Money laundering and bank risk. People 1 Profiles 1 results Last Name ascending Last Name descending.

We test for a link between money laundering and bank risk in US banks.

Aml What Is Anti Money Laundering And Why Does It Matter Mintos Blog

Bank Secrecy Act Bsa Anti Money Laundering Aml Compliance In Remote Deposit Capture Helpful Tips Digital Check Digital Check

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore

Anti Money Laundering Or Aml Solutions Are Provided By Jmr Infotech For Banks To Protect Them From Risks Related To Aml These Ar Money Laundering Money Anti

Aml Compliance Checklist Best Practices For Anti Money Laundering

What Is Money Laundering And How Is It Done

Do Anti Money Laundering Requirements Solve Fake Residency Concerns Tax Justice Network

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Revised Central Bank Amla Guidelines Anti Money Laundering

Aml Compliance Checklist Best Practices For Anti Money Laundering

Finra S List Of Aml Red Flags Has Gone From 25 To 97 Regtech Consulting Llc

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

Anti Money Laundering 2021 Laws And Regulations Usa Iclg

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

Global Banks Defy U S Crackdowns By Serving Oligarchs Criminals And Terrorists Icij

Post a Comment for "Money Laundering And Bank Risk Evidence From Us Banks"