Fca New Technologies And Anti-money Laundering Compliance

AML compliance is required from all FCA registered firms. FCA resources on using new technology to support AML compliance.

Aml Compliance Time To Turn Words Into Actions The Accountant

Learn More and Request Details.

Fca new technologies and anti-money laundering compliance. 2 August 2017 We commissioned a survey and report on emerging technologies with potential for enhancing financial firms work to detect and prevent money laundering and for helping make the UK a hostile environment for criminals money. Anzeige Help Protect Your Business From Financial Crime Reduce Risk When Carrying Out Screening. Learn more about AML regulations and appointing a Money Laundering Reporting Officer.

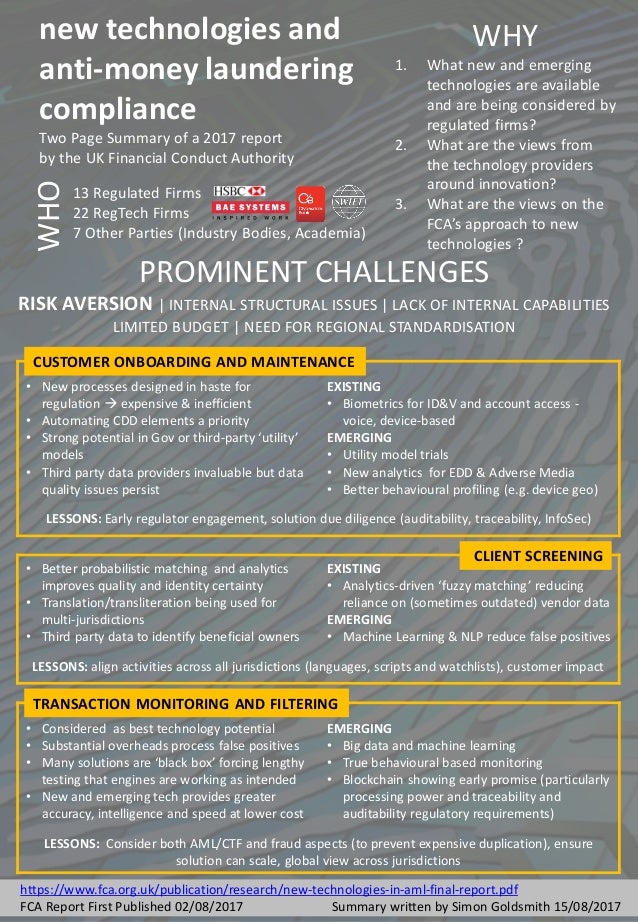

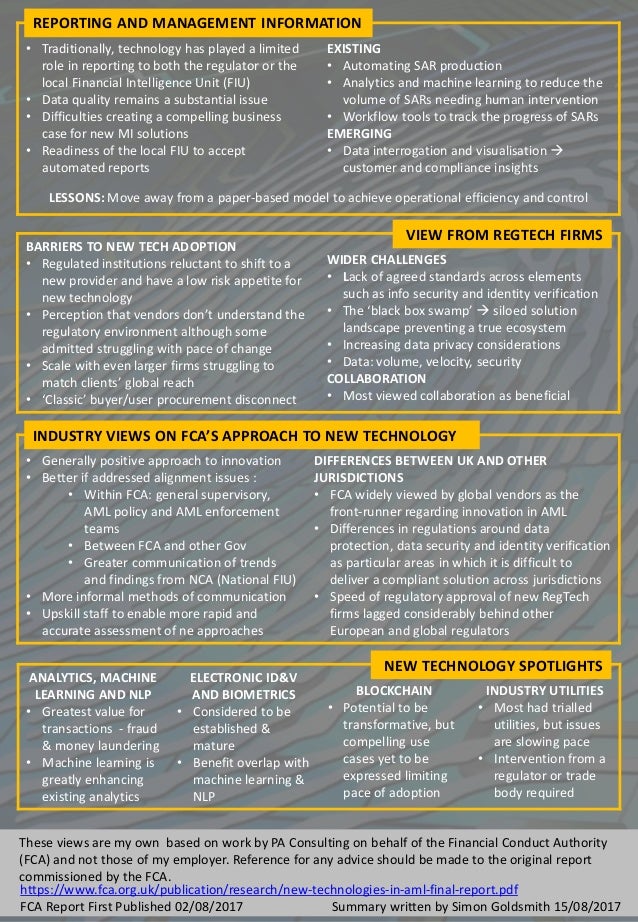

NEW TECHNOLOGIES AND ANTI-MONEY LAUNDERING COMPLIANCE FINANCIAL CONDUCT AUTHORITY 31032017 EXECUTIVE SUMMARY This report details the findings from a study into new technologies in Anti-Money Laundering AML compliance by PA Consulting Group PA on behalf of the Financial Conduct Authority in the UK FCA. In August 2017 the FCA published a report undertaken by PA Consulting on emerging. Home COMPLIANCE SERVICES New technologies and anti-money laundering On August 2nd the FCA published the result s of a survey on new technologies and financial firms work to detect and prevent money laundering to help make the UK a hostile environment for criminals money.

Anzeige Help Protect Your Business From Financial Crime Reduce Risk When Carrying Out Screening. Learn More and Request Details. Unlock A World Of Data-Driven Opportunities.

The report is intended to increase the FCAs understanding of emerging technologies and their potential application to anti-money laundering AML. Technology that Helps Streamline AML Compliance so You Can Stay Focused on Key Workflows. The report details findings of 3 months of research.

The report is intended to increase the FCAs. We commissioned a survey and report on emerging technologies with potential for enhancing financial firms work to detect and prevent money laundering and for helping make the UK a hostile environment for criminals money. New technologies and anti-money laundering compliance report.

New technologies and anti-money laundering compliance report Published date. On 2 August the FCA published its report on new technologies and anti-money laundering compliance. Two page summary of a report commissioned by the UK Financial Conduct Authority.

Anzeige Integrated Monitoring Tools that Help You Comply with Anti-Money Laundering Requirements. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. The FCA publishes report on new technologies and AML compliance.

These views are a personal summary of work by PA Consulting on behalf of the F. INTRODUCTION NEW TECHNOLOGIES AND ANTI-MONEY LAUNDERING COMPLIANCE 4 Background to the review 5 Scope of the review 6 Review approach 7 A SHIFTING LANDSCAPE TECHNOLOGY IN ANTI-MONEY LAUNDERING COMPLIANCE 9 Background to the topic 10 Focus of the section 10 Overall conclusions 10 AML technology decision making considerations 11. In summary the report finds that many new technologies are perceived as having potential in anti-money laundering AML compliance with regulated firms slowly trailing a wide variety of innovative solutions both to manage their financial crime risk and to reduce operational overheads.

Unlock A World Of Data-Driven Opportunities. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Anzeige Integrated Monitoring Tools that Help You Comply with Anti-Money Laundering Requirements.

Technology that Helps Streamline AML Compliance so You Can Stay Focused on Key Workflows. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. The report is intended to increase the FCAs understanding of emerging technologies and their potential application to anti-money laundering AML.

The FCA has shared a number of useful resources on how the financial services industry can use new technologies to support AML compliance particularly in the area of client due diligence CDD. On 2 August the FCA published its report on new technologies and anti-money laundering compliance. On 2 August the FCA published its report on new technologies and anti-money laundering compliance.

Fca Warns Retail Banks Over Aml Failings

Anti Money Laundering What Is Aml Compliance And Why Is It Important

New Technologies And Anti Money Laundering Compliance Personal Summa

8 Ways To Protect Your Firm From Money Laundering

Travel Rule Was A Term Frequently Heard At The V 20 Summit Which Took Place In Parallel With The G 20 Meeting In Money Laundering Bank Secrecy Act Financial

Ex Us Bank Risk Officer Fined Over Aml Compliance Pymnts Com

New Technologies And Anti Money Laundering Compliance Personal Summa

Anti Money Laundering What Is Aml Compliance And Why Is It Important

All You Need To Know About Anti Money Laundering Aml Compliance

Finra S List Of Aml Red Flags Has Gone From 25 To 97 Regtech Consulting Llc

What Is An Aml Compliance Program Complyadvantage

What Is Anti Money Laundering Compliance Tookitaki Tookitaki

Aml Compliance Checklist Best Practices For Anti Money Laundering

Anti Money Laundering In The Uk Who Regulates Me

Anti Money Laundering Ultimate Guide Training Express

Aml Compliance Checklist Best Practices For Anti Money Laundering

Aml Compliance Checklist Tools And Processes For Anti Money Laundering

At The Front Lines Of The Fight Against Money Laundering In Germany Financial Institutions Are Aske Bdo

Post a Comment for "Fca New Technologies And Anti-money Laundering Compliance"