Fca Anti Money Laundering Guidance

Fca anti money laundering guidance. FINRA reviews a firms compliance with AML rules under FINRA Rule.

Fca Warns Retail Banks Over Aml Failings

In addition to the powers available under the Money Laundering Regulations the FCA will have the power to take regulatory action against authorised firms for failures which breach the FCAs rules and requirements for example under Principle 3 SYSC 326R or SYSC 611R.

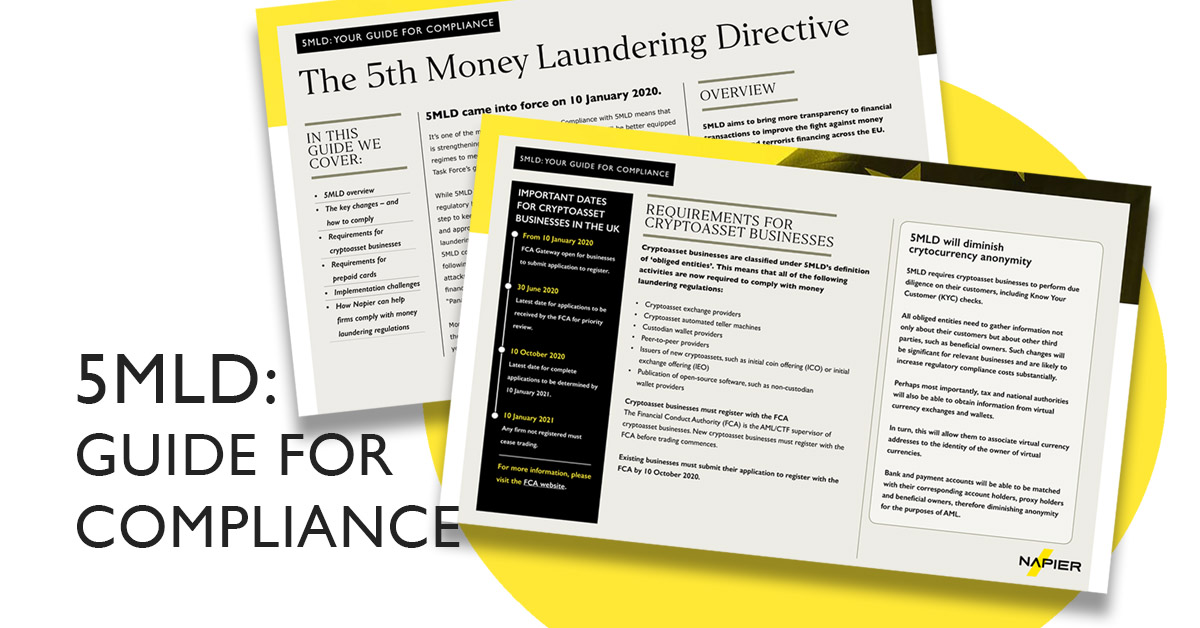

Fca anti money laundering guidance. The FCA is empowered to impose fines and at least in theory bring criminal prosecutions for breaches of The Money Laundering Terrorist Financing and. This page highlights some specific new areas that firms need to comply with. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force.

Learn more about AML regulations and appointing a Money Laundering Reporting Officer. Appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager.

They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation.

It applies only to business relationships undertaken in the course of business in the UK. Under regulation 78 of the Money Laundering Regulations. When considering a firms systems and controls against money laundering and terrorist financing we will consider whether the firm has followed relevant provisions of the JMLSGs guidance guidance issued by the FCA or taken account of the ESA guidelines.

24 It is proposed this guidance will come into effect on 1 January 2018. Anti-money laundering guidance for the legal sector. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation.

21 This guidance is aimed at any institution that has its anti -money laundering systems and controls overseen by the FCA1 It discusses how they can meet their obligations when opening new relationships or monitoring existing relationships. Specific anti-money laundering guidance for barristersadvocates 2a trust or company service providers 2b notaries 2c 2b and 2c are to be read alongside part one of the guidance. HMRC issues guidance on anti-money laundering in the UK including compliance requirements for customer due diligence and transaction monitoring and the need to issue an anti-money laundering policy statement.

In practice this includes businesses that offer finance leases commercial lenders and providers of safe deposit boxes. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group. We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations.

The Joint Money Laundering Steering Groups JMLSG guidance for the UK financial sector on the prevention of money laundering and combating terrorist financing isrelevant guidanceand is approved by HM Treasury under theMoney Laundering Regulations. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. SYSC 636 G 01042009 RP.

Skip to main content Skip to search. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. The guidance has two parts.

Based approach guidance agreed by Anti-Money Laundering Supervisors Forum members in 20088. The MLRO supervises the firms compliance with its AML. As confirmed in DEPP 623G.

It is our belief that this publication can provide a measure of guidance and that it can spur additional solutions. 23 The sourcebook has the status of general guidance issued by the FCA under section 139A of the Financial Services and Markets Act 2000 as amended. The Financial Conduct Authoritys FCAs predecessor streamlined its rules by removing the Money Laundering.

AML compliance is required from all FCA registered firms. Basic AMLCFT concepts interpreting and implementing regulatory guidance correspondent bank reporting and systems alignment interpreting USEU regulatory requirements and technology-based solutions. 2a is designed to be read independently of part one.

FCG 318 13122018. In March 2017 we consulted on guidance GC172 in. They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively.

Her Majestys Revenue and Customs shares the responsibility to investigate money laundering offenses with the FCA.

Introduction To The Financial Conduct Authority Money Laundering In The Uk Tookitaki Tookitaki

Uk S Fca Issues Warning Letter To Banks Over Anti Money Laundering Failings Biia Com Business Information Industry Association

Significantly High Number Of Crypto Firms Not Meeting Aml Standards

Uk Financial Conduct Authority Fines Commerzbank London Branch 37 8 Million For Aml Failings Argos Kyc

Fca Fines Deutsche Bank 163 Million For Serious Anti Money Laundering Controls Failings Planet Compliance

Demystifying The Fca S Demands A Detailed Guide For The Uk S Aml Requirements Sumsub Com

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk

Fca Warns Crypto Businesses Fail To Meet Uk S Money Laundering Regulations Standard Atf News

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An

Crypto Firms Still Flouting Anti Money Laundering Rules Says Fca

Fca Uk Banks Are Failing In Their Aml Approach A Team

Fintech And Fincrime The Global Regulatory Landscape

German Bank Fined 37 8m For Anti Money Laundering Failings International Adviser

The Fca Reclassifies Cryptoassets But Is It Moving Away From Its Technology Neutral Approach On The Chain

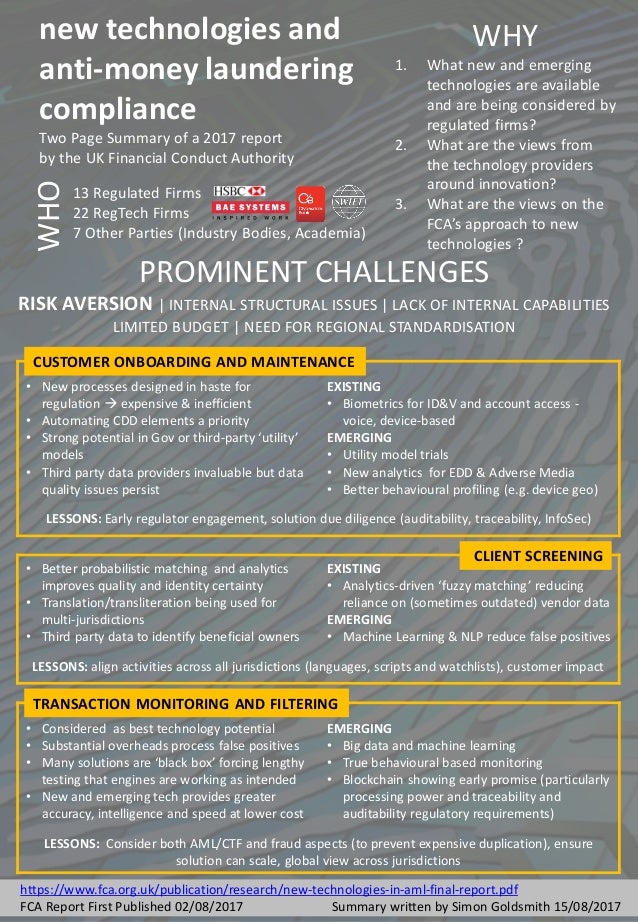

New Technologies And Anti Money Laundering Compliance Personal Summa

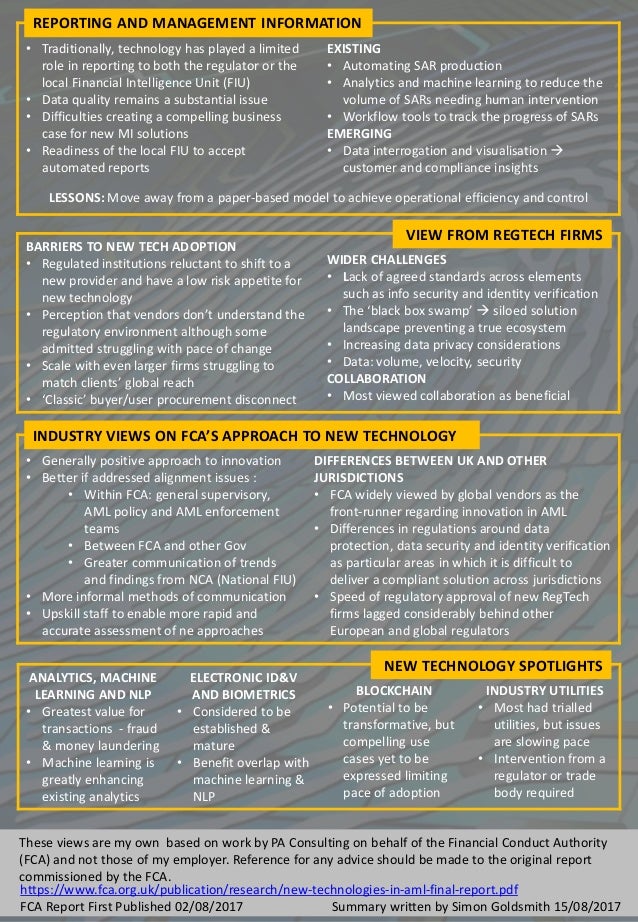

New Technologies And Anti Money Laundering Compliance Personal Summa

Fca Warns A Significantly High Number Of Crypto Firms Not Meeting Anti Money Laundering Rules

Uk S Fca Lays First Ever Criminal Charges Of Money Laundering Central Banking

Post a Comment for "Fca Anti Money Laundering Guidance"